Conventional mortgages are the most popular form of home financing for buyers in the United States. However, it may not always be clear how these loans differ from other loans, such as those provided by government agencies. To help you gain a better understanding of conventional loan basics, here is a quick guide with further information:

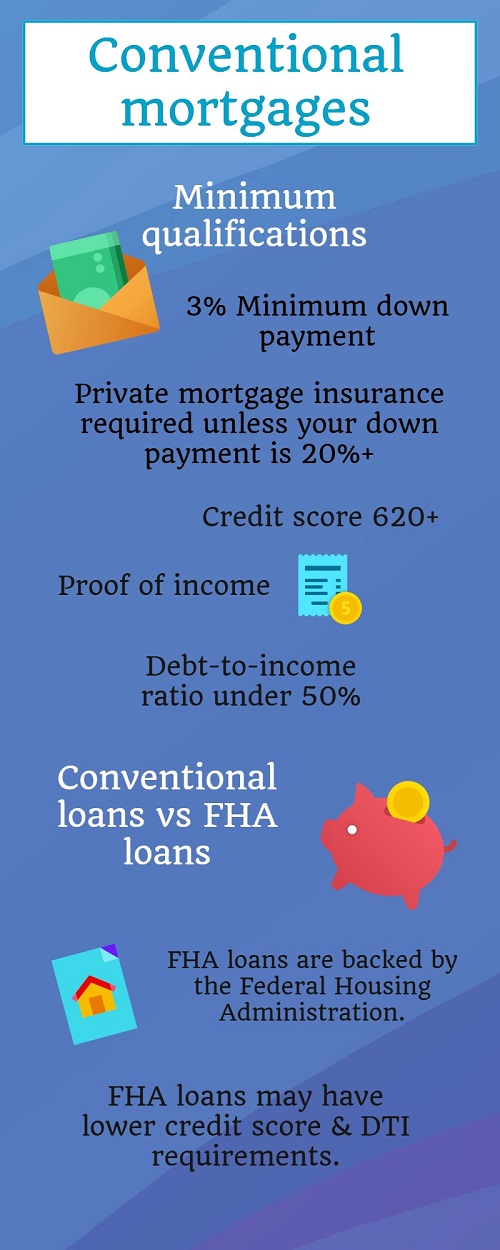

When obtaining conventional financing, your lender will examine your financial situation. The loan officer may request information including your credit score, income statements and debt to income ratios.

A down payment is required for conventional loans. Each lender has different minimum requirements, but the larger the down payment, the less money you’ll have to pay back over time.

Many believe a 20% down payment is required for conventional loans, but the minimum requirement is typically much lower. You can find mortgages with minimum down payment requirements anywhere from 3% to 20% of the overall purchase price.

Your choice of down payment amount can affect the terms of your mortgage, like interest rate or the need for private mortgage insurance.

Government-backed home loans have specific features to suit some homebuyers.

The Federal Housing Administration (FHA) is a government institution offering home loans for buyers who meet certain qualifications. Government-backed loans have advantages for those with bad credit or other financial roadblocks, but require other qualifications for approval.

Conventional mortgages tend to have higher interest rates than FHA loans, although these loans typically require borrowers to pay mortgage-insurance premiums.

Interest rates charged on a conventional mortgage vary by several factors, including the term and amount borrowed. However, interest rates are also subject to change every year based on the overall economy. Many buyers choose to wait for a period when interest rates are lower to apply for a mortgage, regardless of the loan type.

Ultimately, your choice of loan will depend on your personal circumstances. The more you know about different types of mortgage, the better equipped you’ll be for your journey into thefinancial real estate marketplace.

With over 10 years experience serving the Dallas and metro area, I am dedicated to providing my clients with outstanding customer service and to earning the referral business of my clients. I focus on family values and customer service. I have made a lot of friends in this business. Constant communication is a big part of my success. Proven professional who brings knowledge, skill and care to every transaction. I would love to be your realtor and if you know of anyone who is thinking about buying or selling a home or would just like additional information about property values in my area then call, text or email me today. If you or someone you know are a veteran, firefighter, policeman, teacher, doctor, nurse contact me about special incentives. If you or someone you know has a blemish on your credit report and is not in active bankruptcy contact me about a new company that can help you get into a home. If you need a reputable credit repair company that will give you help to get back on the right track then I have a great company. If you want to purchase a home but still don't have enough saved there are still available funds to help you with that. Are you or someone you know relocating to the Dallas area? I have helped families relocate here. I understand your family's needs. Certifications: New Home Construction, Senior Designation, American Warrior, First Time Home Buyer, EPRO,Relocation